Pawn Loans

Pawn Loans ? $1,000 to $50,000

U-Pawn is a Leading Pawn Shop in Sydney Specialising in Pawn Loans against Cars | Motorcycles | Boats and Trucks. We also pawn Machinery | Recreational Vehicles | Bicycles | Caravans | Trailers | Farm Equipment and even Aircraft.

Pawn Loans, unlike personal loans, can be a quick way to borrow money because it doesn’t involve a credit check or application process. Your loan amount is based on the value of the item you pawn.

U-Pawn is one of a very few pawn shops in NSW that will offer pawn loans on against Cars. But what really sets us apart from most pawn shops is our appetite to offer pawn loans against Motorbikes, Boats, Trucks and even Aircraft. We also provide pawn loans against Machinery and Equipment, Caravans, Jet Skis and high-end Bicycles. We’re not your ordinary pawnbroker.

?? No Credit Checks

✔️ No Establishment Fees

? No Repayments First 3 Mths

Have a Bad Credit Rating? – Doesn’t Matter!!

Your good or bad credit rating is not a reflection in getting a pawn loan from us because you are pledging your asset as security by handing it over to us until your loan (and any interest due) is fully repaid. This is the essence of a pawn loan. Learn more about why your bad credit rating doesn’t really matter >

Phone Us ☎️ 1300 205 558

Pawn loans are the easiest way get cash fast $$

How many times have you needed cash fast to pay an urgent bill or take advantage of a great opportunity? – Plenty of times for sure!

But what are your options if you haven’t got the cash on hand – indeed, it can be embarrassing asking friends and relatives for money; and its tedious and time consuming trying to arrange a short-term bank loan – often there is just no time to that – and made all the harder if you have a bad credit rating, or perhaps no credit rating at all.

So, by far, the easiest way to get a cash loan fast, even if you have a bad credit rating – even if you are on Centrelink benefits – is to get a pawn loan by pawning an asset you own.

We offer pawn loans against a wide range of items including:

4 Great reasons to get a pawn loan from U-Pawn

- Fast Access to Cash – There is no faster way to capitalise on goods that you own -a car for example- than with a pawn loan. We appraise the value of your goods and offer a fair loan value to help meet your needs. Walk out with the cash you need!

- Discretion is assured – When you take out a pawn loan with us, no one else needs to know about it. As we don’t do credit checks there is no central credit record of your loan so it will not impact your credit rating.

- No Hassles – When you use something you own as collateral for a pawn loan, you avoid the excessive paperwork and credit requirements of a traditional or unsecured loan. We make it easy with no credit checks and no formal applications.

- Safe storage – Whatever you pawn with us will be stored in a safe facility that is monitored 24/7. We take the care of your property very seriously. You can rest assured that your car or motorcycle or other assets are safe with us.

We’re conveniently located in Parramatta Sydney

We can also come to you, just ask!

FAQs

Frequently Asked Questions

What is a pawn loan exactly?

A pawn loan is a type of secured loan, which means it’s backed by collateral. In this case, that’s the pawn—the item you bring in and leave with the pawnbroker. If you pay off the loan in time, you’ll get your pawn back. But if you don’t, the pawnbroker gets to keep the pawn and put it up for sale as payment for the loan. As long as you have something of value, pawn loans have no other qualification requirements. That’s their strength; unlike other loans, which rely on checking your income and your credit score, you could walk into a pawn shop with no income and no credit and still get a loan. In fact, pawn loans are one of the oldest forms of lending for this reason. After all, our ancestors didn’t have credit rating scores or pay slips to prove their creditworthiness to lenders, and so they used a collateral-based system like this.

Who takes out pawn loans?

Pawn loans serve a wide variety of needs for a variety of people; from the unemployed to the rich and famous. Indeed, it doesn’t matter if you are self employed, retired, on a pension, a carer for a family member, on workers compensation benefits, a student, or if you are unemployed (in between jobs), or a multi-millionaire – you can take out a pawn loan against just about anything you own.

Did you know that pawn loans are used by the rich and famous? – this is because a pawn loan offers absolute discretion. You might have millions of dollars in the bank, but that doesn’t mean you can get cash immediately. For example, the money might be on a term deposit requiring a lead time to redeem it – or the money might be being used to secure other loans, mortgages or business expenses for example. Sometimes, people just don’t want their partners to know about their spending – perhaps they’re off to the casino or the races and don’t want to have to justify a punt; or as we experienced some time ago … a husband surprising his wife with a $25,000 bracelet to celebrate their 25th wedding anniversary – it wouldn’t have been a surprise if he purchased it on their joint credit card account.

Many customers, have come across a ridiculously cheap bargain which has to be paid for in cash immediately – often customers will come across a car or boat being sold at half its real value, and which needs to be paid for in cash then and there … even farmers come across exceptional deals on livestock, where the seller wants money in a hurry in return for a bargain cash price – so we do from time to time pawn tractors and other farm machinery and equipment. Sometimes for only for a days while the farmer makes a huge profit on flipping the livestock at sales … try getting a bank to help you out with that. This is why, people in the know use pawn loans to fund their urgent short term cash needs.

Even high flying executives take out pawn loans – for example, to pay a margin call on stocks and shares, or they want to buy a bucket load share options on a good tip? – but they need to bought right now – not tomorrow – but they don’t have the funds today – so the easiest solution is to pawn something or some-things they own of of sufficient value and we simply deposit the cash directly into their share trading account or give them the cash directly. It’s that easy!

Even if you’re a pensioner, of between jobs, or in part time or casual employment, why should you be denied the opportunity of taking advantage of a bargain … of starting a business – try getting a bank to listen …. no chance! But, if you have something of sufficient value to pawn you can get a pawn loan without fuss.

Quite frankly, But what are your options if you haven’t got the cash on hand – indeed, it can be embarrassing asking friends and relatives for money; and its tedious and time consuming trying to arrange a short-term bank loan – often there is just no time to that – and made all the harder if you have a bad credit rating, or perhaps no credit rating at all.

What can I use a pawn loan for?

In most cases pawn loans are short term loans -set at 90 days- needed urgently for a variety of reasons including for:

- Medical expenses;

- Education costs – including school fees, uniforms, stationery or tech items;

- Car expenses – including repairs, rego, tyres or insurance;

- Family emergencies or funeral costs;

- Vet bills;

- Legal expenses, even for bail

- Moving costs – including rental bond, body corporate fees, transport;

- Home repairs and renovations;

- Travel, holidays and accommodation;

- Gifts for those you love;

- and more…

Pawn loans can also be used for business purposes – for example, to solve short term cash flow problems while you’re waiting on invoices to be paid; perhaps you are buying stock for a new business venture or buying equipment to fit-out premises … all too often with a bad credit rating or low credit score banks will just laugh at you or make it too hard and costly. So, it makes sense to pawn your assets when you need a cash loan but have a bad or poor credit rating.

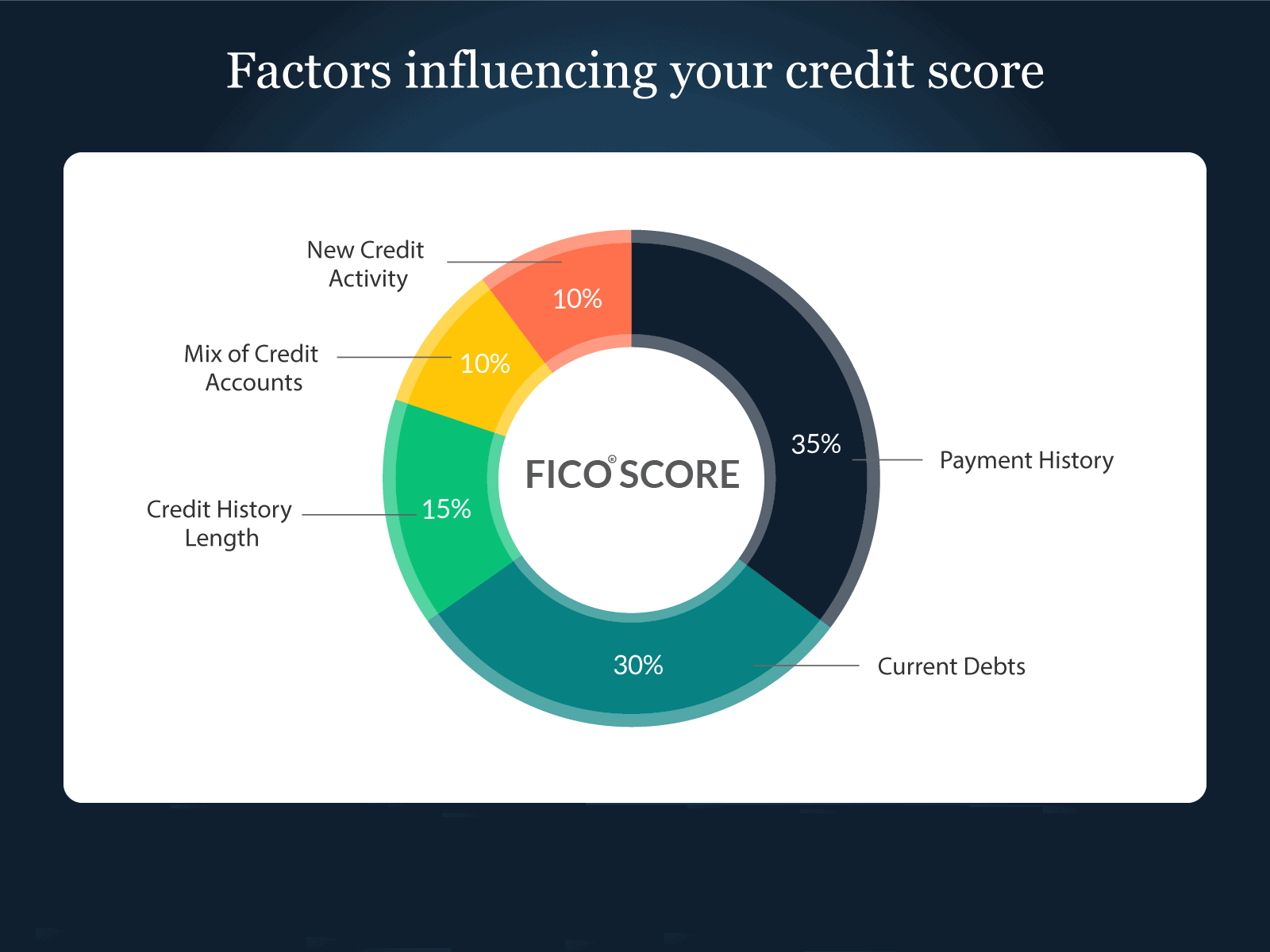

Does it matter if I have a bad credit rating?

To begin with, it’s not great! Simply put, bad credit is a term used to describe a person’s credit history when they have had trouble paying loans or other bills on time. This history is summarised with a score that indicates the borrower’s credit risk. A low credit score signals bad credit, while a high credit score is an indicator of good credit. If there are defaults, missed payments or other negative items on your credit report, these will make your score go down, resulting in either loan denials from lenders, or an approval with a higher interest rate. The lower the credit score the more you are perceived a higher risk for borrowing. Other common phrases used for bad credit loans include loans with bad credit rating, bad credit history loans, loans for bad credit score, loans with poor credit, unsecured loans with bad credit, personal loan with bad credit, bad credit car loans, online bad credit loans Australia etc. Learn more about bad credit loans >

I’m trying to build up my credit rating – will taking out a pawn loan affect my credit score?

No – it shouldn’t because there is no typical loan application process; nothing is entered on any credit agency register because, all you need to do is bring us the goods you want to borrow against and we will give you a cash loan instantly. The loan is secured against the goods; so there is no impact on your credit score even if you default on a pawn loan.

So, you can forget the piles of paperwork, scanning, emails back-and-forth, the need for employment history checks (more difficult if you’re self employed) and the long wait for an answer – we make getting a bad credit loan quick and simple, and without establishment fees.

Why is it so hard to get a short term loan from a bank?

Firstly, banks prefer to lend large sums for extended periods; 25 year mortgages on property being a prime example. They really don’t like mucking around with short term loans; it creates too much volatility in their traditional business models. Nevertheless, besides having a bad credit rating, other reasons for being declined a short term personal or business loan include already having a high debt-to-income (DTI) ratio which impacts your forecast debt serviceability. In Australia, Financial Services Entities (FSE’s) such as banks and lending institutions are required to measure your ability to repay a loan (and interest) against a whole bunch of subjective criteria. Perhaps the lender might think you’re borrowing too much money for an asset which can be subjective and open to interpretation. That is why most FSE’s just cut to the chase and require bricks-and-mortar security with heaps of leeway for them to recover their money should you be unable to repay the loan. Other reasons why its hard to get bank loans can include:

- cash flow issues;

- leaving it too late;

- history of unstable employment;

- not being in a job long enough;

- being part-time or casual work (i.e., hospitality sector);

- not being in business long enough;

- having a low credit score;

- investing in second-hand assets;

- having poor supporting documentation (common problem for small business and sole traders)

- bias against retired persons, pensioners, people on Centrelink benefits, people in low paid work -carers for example- people on workers compensation, and students for example.

When you you take out a pawn loan none of this really matters.

Is a Pawn Loan the same as a Pay Day Loan?

Firstly, U-Pawn is not a payday lender. A Payday lender lends you money on your next pay cheque; essentially, you will be required to arrange for your employer to pay your next pay cheque, or part of it, to the lender in repayment of your loan. A payday lender will usually take into account things like your credit rating, and that of your employer’s, your term of employment with your employer and things like that. This can take some time. Some risks of payday loans:

- Unaffordable repayments;

- Multiple applications;

- Establishment & management fees;

- Can effect your credit rating.

Typically these pay day loans are unsecured, which means that the lender can initiate legal proceedings against the customer if they can’t repay. Also consider that if your credit score is already low, applying for a new loan could impact it further. Each loan application you make is generally recorded on your credit report, while your repayments on the loan are also recorded.

A Pawnbroker is different. Firstly, pawn loans are usually made in a matter of minutes once the goods to be pawned are assessed (usually a very quick process). Importantly, there are no establishment fees or checks on your credit worthiness, so no-one need know that you are taking out a loan. Nor does a Pawnbroker have a hold over your next pay cheque. generally, a Pawnbroker will loan you money against the pawned goods which are used to secure a loan; until the loan and interest are paid in full subject to the terms of your loan agreement.

In most cases, you will need to bring the goods to us to assess. In some cases, we will be happy to come to you to asses the boat’s value. For some unique or obscure types of assets, we will usually insist on an appraisal from one of our qualified trusted experts. That process could take a few hours or perhaps days.

Interest rates are calculable on a monthly basis and will be fixed for the loan contract period (90 days) at the time the contract is made. The interest rate we will charge you will depend on a range of factors, including as to the amount being borrowed and value of the goods being pawned. This is called the ‘loan risk ratio‘. The higher the risk to the pawnbroker, the higher the interest rate.

Note: A valuation for a pawn loan is not a ‘market valuation’. It is a valuation exclusively for our own purposes and is not public. In most circumstances a pawn loan valuation will be significantly less than a market valuation.

How much money can I borrow?

Bad credit loans without a credit check are available from $1,000 to $50,000 (sometimes more on request).

The amount you can borrow will depend on the value of the goods being pawned. It is unlikely you could borrow the full value of the goods. Generally, a pawn shop will only lend about 50% to 60% of the wholesale value of the goods. So, using a car for example, if you have a car with a pawn value of $30,000 you might be able to borrow cash to a maximum of around $18,000 perhaps a few thousand more depending on the condition of the car.

Once approved, a cash loan is guaranteed – we’ll process your loan in just minutes and provide you cash in hand or an immediate bank transfer to an account of choice. We’re flexible either way. The point is, pawn loans are almost always cash loans. This is why pawn loans are so popular these days because you can borrow money instantly.

Another reason for the popularity of pawn loans is that no one knows that you’re getting a cash loan because it doesn’t go through your bank account and is not registered on your credit rating file. So your privacy and discretion are assured. This is a real advantage if you have a bad credit rating or you are being chased for cash, getting an instant cash loan against something you own by pawning it with us is a logical and quick solution to your immediate cash flow problems. No one needs to know but you.

Note: We are not a payday or personal loan lender.

To get a pawn loan you will need to have:

+ Proof of your ownership

+ Acceptable identification

To see a complete list of acceptable I.D. please visit our comprehensive FAQ’s section >

What are the usual pawn loan terms

Our loans are set for three months, however, repayment of the loan can be made earlier without penalty fees. Loans may be extended for a short term past the three-month period subject to additional conditions. Borrowers have the right to pay interest periodically or at the expiry of the loan.

Indeed, many of our customers need to get a cash loan for just a few days or a few weeks to get them over a financial hump or they might be having to put their financials together to arrange a traditional loan. A pawn loan against your car, for example, can tide you over during this period.

Our Usual Loan Conditions

Pawning your goods means we will use your goods as security, sometimes called collateral. We will keep possession of the goods for the duration of the loan. Therefore your credit rating is immaterial to borrowing money from a pawnbroker.

You must have legal and ownership rights to the goods you want a loan against. The goods should have nil (or virtually nil) finance owing on them. Nevertheless, if the goods have money owing on them we would need to consider the circumstances before offering to pawn them. This could mean a few hours delay buy we would still aim to make it a same-day cash loan. You can borrow money instantly.

Just because you have suffered an unexpected financial difficulty, just because you might have a bad credit rating or no credit rating at all, just because you’re a pensioner or unemployed, or under-employed, and on Centrelink benefits, just because you are self employed and your books are not perfect and up-to-date, just because you don’t have someone who will guarantee a loan, just because you might be a bankrupt, you should not be precluded from getting an instant cash loan by pawning something.

To learn more about our pawn loans please visit our FAQs page by clicking on the button below:

Page Topics: pawn loans | pawn shop loans | pawnbroker loans |pawn car loans | pawn title loans | pawn loans online