Pawn a Car – Sydney

U-Pawn – Fast Cash Loans to $50,000

Sydney’s Leading Car Pawn Shop

☎️ 1300 205 558

❌ No Credit Checks

❌ No Establishment Fees

❌ No Repayments First 3 Mths

Need Cash Fast!!! … Pawn a Car for Cash $$

Instant Cash loans from $1,000 to $50,000+

We aim to keep it a simple process.

Phone Us ☎️ 1300 205 558 or fill-out our Online Enquiry Form and we’ll call you with a free no obligation quote.

Better still, you can ‘SMS’ photos of your car and we’ll give you a free pawn-value appraisal. Please click here to see how >>

We Pawn Most Types of Cars

- Sedans

- Coupes

- Sports Cars

- SUV’s

- 4x4s

- Dual Cabs

- Classic Cars

- Vintage Cars

- People Movers

We Specialise in Loans against

European and Prestige Cars

$$ Get Cash in Minutes $$

To pawn a car is super simple – it ‘s not like getting a traditional loan. There’s are No Formal Applications – No Credit Rating Checks – No Upfront Fees – No waiting around for an answer and No Explanations as to why you need the money or what you’re going to do with it.

Once we assess and verify your car’s ownership – its registration and history – and your identification – we will let you know how much we will lend against your car • the interest rate we will charge you • and the final terms of the loan.

Note: When you pawn a car, we keep the car as collateral (the “pledge”) until the loan and interest is repaid in full. See more in the FAQ’s section below.

Find Us – If you’re in Sydney and looking to pawn a car near me click here >

Call Us to Discuss Your Cash Needs

☎️ 1300 205 558

Use our Enquiry Form and we’ll call you

‘SMS’ photos of your car and get a free loan-value appraisal. Click here to see how >>

Important Information About Pawning a Car

To get a loan against your car you will need to have:

Proof of your ownership

- Registration Papers;

- Sales Invoice; or

- other acceptable proof of purchase to prove your ownership.

Acceptable identification

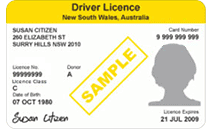

To protect and verify your identity, you will need to provide documents that evidence:

- Your full name;

- Your current address;

- Your date of birth; and

- Your signature.

Acceptable documents include:

- Drivers Licence with photo;

- Australian Passport;

- Birth Certificate;

- Australian Passport;

- Utility bill – showing name and current address;

- Government Issued Card with photo e.g. Proof of Age card;

- Medicare Card;

- Seniors Card;

- Bank or Income statement;

To see a complete list of acceptable I.D. please see the FAQ’s section below.

We’re conveniently located in Parramatta – Sydney

No Time to Lose? … Call Us or Apply Online!

U-Pawn is a high-value collateral lender specialising in pawning Cars | Motorcycles | Boats and Trucks. We also pawn Machinery | Recreational Vehicles | Bicycles | Caravans | Trailers | Farm Equipment and even Aircraft.

Please visit the relevant page for any other asset you want to pawn:

FAQs

Frequently Asked Questions

Can I pawn a car?

Absolutely Yes – you can pawn a car for an instant cash loan. In fact, you can pawn a car, and just about any other type of vehicle for that matter. To pawn a car in NSW you must have attained at least 18+ years of age and own the car or have legal title to it. See the types and makes of cars we pawn >

Is pawning a car the same as getting a loan on a car?

Pretty much Yes – but there are some fundamental differences between the practical and legal concepts of a standard type of loan secured against a car and that of a car pawn loan. For example, a standard lender -a bank, finance broker, etc’- might loan you money against a car by taking security over the car’s title. These loans are sometimes referred to as title loans which are more popular in the UK and USA than in Australia. This is where the lender would effectively caveat a right to the car’s title as security collateral for a loan. More often than not, a borrower taking out such a loan would have to provide their financials -i.e., proof of employment, personal and solvency information, credit checks, application fees, etc’– in order to get a loan. Sometimes, a borrower might also be required to get a co-signatory to the loan contract, sometimes called a guarantor. All this takes time and is not guaranteed to result in getting a loan.

Whereas if you need a cash loan quickly, you can get a secured loan against your car by pawning it without the hassle of providing your financials or having to wait around for approval. Basically, it’s just a matter of driving into our pawn shop and getting your money. Just like a standard secured loan against your car, we also use it use as collateral to secure the loan, but the fundamental difference is that we keep the car in our possession until the loan and due interest are repaid in full. This is legally required when you pawn a car.

The advantage of being able to pawn a car and getting a secured loan against it, is that a loan is virtually instant and paid in cash. Additionally, we do not do credit checks – there are no upfront fees required – you don’t have to fill out any formal applications – you don’t have to wait around for an answer – and you don’t have to disclose your financials, nor do you have to tell us what you want the loan for. So, getting a secured cash loan against your car by pawning it is a great way to get a quick cash loan when you really need it. It is also worth noting that if you are borrowing for business reasons the interest on a car pawn loan might be entirely tax-deductible.

Indeed, the easiest way to get a loan on a car is to pawn it. This way, you can a loan with your car as collateral; you can even get a loan against a car with no credit check, it’s that easy. You can even get a loan on an old car, even if you are on a bridging visa, or unemployed, or on Centrelink. You can even get a loan on a car which is under club registration, limited registration, or in the middle of restoration. To see more FAQ’s about a loan on car please click here >

Note: U-Pawn is not a payday lender. See the difference >

Can I pawn a car and still drive it?

In New South Wales a person borrowing money from a licensed Pawnbroker must leave the asset being borrowed against -for example the car being pawned- with the pawn shop. Essentially, the loan is secured against the car until the debt and due interest are repaid. Learn more about pawning your car >

How much money can I borrow against my car?

It depends on the value of the car you want to pawn. It will be unlikely you could pawn a car for its full value. Generally, a car pawn shop will only lend to about 50% to 60% of the wholesale value of the car. So, if you have a car with a pawn value of $30,000 you might be able to borrow a maximum of around $18,000 perhaps a few thousand more depending on the condition of the car.

Car pawn loans are available from $1,000 to $50,000. In some cases, we will consider lending more.

Do you get more if you pawn or sell?

Often, you can get more money for your car by selling it. However, when you pawn a car, you can get the money you need, instantly, and you get to keep your car. Learn more about the advantages of pawning a car over selling it >

Can I pawn a car with a bad credit rating?

The short answer is yes. People wanting to pawn a car often ask us, does a bad credit rating matter? Your good or bad credit rating is not a reflection in getting a cash loan from us because you are pledging your car as collateral by handing it over to us until your loan (and any interest due) is completely repaid. This is the essence of pawning. Learn more about >

Do I have to sign the car over?

No. When you pawn a car, you are not required to sign the car over to us. When you take out a pawn loan with us (and other pawnbrokers in NSW) you will get a ‘Pawn Ticket’ and ‘Loan Agreement’ which will stipulate the terms, conditions, and interest rate for the loan.

Do you only pawn cars in Sydney?

While U-Pawn is a specialist car pawn shop servicing all suburbs and regions of Sydney and Greater Sydney, we also service the New South Wales regions of the Blue Mountains, Southern Highlands, Central Coast, Newcastle & Hunter, North Coast & Mid North Coast, New England, Western Tablelands, Central Tablelands, Southern Tablelands, South Coast, Illawarra, and Wollongong. We hope you find this information helpful. For more details about how to pawn a car, visit ePawn’s car pawning page.

To learn more about how to pawn a car please visit our FAQs page by clicking on the button below:

This page has helpful information about how you can get a short term cash loan loan against a car: See pawn my car for a cash loan>, can I pawn my car, how to pawn your car for cash, learn about car pawn, get a car pawn loan against car and still drive it, how to hock my car in sydney and about our car pawn shop U-Pawn is a specialist car pawnbroker