Hock My Car – Parramatta

U-Pawn – Fast Cash Loans to $50,000

Sydney’s leading Car Pawn Shop

☎️ 1300 205 558

❌ No Credit Checks

❌ No Establishment Fees

❌ No Repayments First 3 Mths

Need Cash Fast!!! … Hock your Car for Cash $$

Instant Cash loans from $1,000 to $50,000+

We aim to keep it a simple process.

Phone Us ☎️ 1300 205 558 or fill-out our Online Application and we’ll call you. Better still, we can come to you to offer a free pawn-value appraisal.

Note: When you hock a car, we keep your car as collateral (the “pledge”) until the loan and interest is repaid in full. See more in the FAQ’s section below

What Cars will we Hock?

We pawn most popular makes and models of cars including:

- Sedans

- Coupes

- Sports Cars

- SUV’s

- 4x4s

- Dual Cabs

- Classic Cars

- Vintage Cars

- People Movers

We also hock Classic Cars, Muscle Cars, Vintage Cars & Antique Cars.

See all the types cars we hock:

We also Specialise in Loans against

European and Prestige Cars

$$ Get Cash in Minutes $$

Once we assess and verify your car’s ownership – its registration and history – and your identification – we will let you know how much we will loan against your car • the interest rate we will charge you • and the final terms of the loan.

Interest rates are calculable on a monthly basis and will be fixed for the loan contract period at the time the contract is made. The interest rate we will charge you will depend on a range of factors, including as to the amount being borrowed and value of the goods being hocked. This is called the ‘loan risk ratio‘. The higher the risk to the pawnbroker, the higher the interest rate. See more in the FAQ’s section below.

Important Information

About Hocking a Car

To get a loan against your car you will need to have:

Proof of your ownership

- Registration Papers;

- Sales Invoice; or

- other acceptable proof of purchase to prove your ownership.

You will also need to have the ability to login to NSW Services or authorisation to telephone the Motor Registry for details of the car’s registration; and,

You will also be responsible to pay the cost of a REV’s Check (vehicle history) on your vehicle through NSW Roads and Maritime Service (about $35.00).

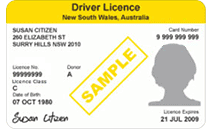

Acceptable identification

To protect and verify your identity, you will need to provide documents that evidence:

- Your full name;

- Your current address;

- Your date of birth; and

- Your signature.

Acceptable documents include:

- Drivers Licence with photo;

- Australian Passport;

- Birth Certificate;

- Australian Passport;

- Utility bill – showing name and current address;

- Government Issued Card with photo e.g. Proof of Age card;

- Medicare Card;

- Seniors Card;

- Bank or Income statement;

To see a complete list of acceptable I.D. please see the FAQ’s section below.

We’re located in Parramatta Sydney

We can also come to you, just ask!

U-Pawn is a high-value collateral lender specialising in hocking Cars | Motorcycles | Boats and Trucks. From time to time we also hock Machinery | Recreational Vehicles | Caravans | Trailers | Farm Equipment and even Aircraft.

Please visit the relevant page for any other asset you want to hock:

FAQs

Frequently Asked Questions

What does “Hock” mean?

People often ask what does hock my car mean. It means pawn my car for a cash loan. Hock is a very old word derived from the word hawk, meaning to trade goods. Some consider pawnbroking to be the second oldest profession; we all know what the oldest profession really is:)

Can I hock my Car?

Absolutely Yes – you can hock your car for an instant cash loan. In fact, you can hock your car, or just about any other type of vehicle for that matter. To pawn a car in NSW you must have attained at least 18+ years of age and own the car. See the types and makes of cars we hock >

Is hocking a car the same as getting a loan on a car?

Pretty much Yes – but there are some fundamental differences between the practical and legal concepts of a standard type of loan secured against a car and that of a car (hock) pawn loan. For example, a standard lender -a bank, finance broker, etc’- might loan you money against a car by taking security over the car’s title. These loans are sometimes referred to as title loans which are more popular in the UK and USA than in Australia. This is where the lender would effectively caveat a right to the car’s title as security collateral for a loan. More often than not, a borrower taking out such a loan would have to provide their financials -i.e., proof of employment, personal and solvency information, credit checks, application fees, etc’– in order to get a loan. Sometimes, a borrower might also be required to get a co-signatory to the loan contract, sometimes called a guarantor. All this takes time and is not guaranteed to result in getting a loan.

Whereas if you need a cash loan quickly, you can get a secured loan against your car by hocking it without the hassle of providing your financials or having to wait around for approval. Basically, it’s just a matter of driving into our pawn shop and getting your money. Just like a standard secured loan against your car, we also use it use as collateral to secure the loan, but the fundamental difference is that we keep the car in our possession until the loan and due interest are repaid in full.

The advantage of being able to get a secured loan against your car by hocking it is that a loan is virtually instant and paid in cash. Additionally, we do not do credit checks – there are no upfront fees required – you don’t have to fill out any applications – you don’t have to wait around for an answer – and you don’t have to disclose your financials, nor do you have to tell us what you want the loan for. So, getting a secured cash loan against your car by pawning it is a great way to get a quick cash loan when you really need it. It is also worth noting that if you are borrowing for business reasons the interest on a car pawn loan might be entirely tax-deductible. To see more FAQ’s about a loan against a car please click here >

Note: U-Pawn is not a payday lender. See the difference >

Can I hock my car and still drive it?

In New South Wales a person borrowing money from a licensed Pawnbroker must leave the asset being borrowed against -the car being hocked- with the pawn shop. Essentially, the loan is secured against the car until the debt and due interest are repaid. Learn more about pawning your car >

How much money can I borrow against my car?

It depends on the value of the car you want to hock. It will be unlikely you could borrow the full value of the car. Generally, a pawn shop will only lend to about 50% of the wholesale value of the car. So, if you have a car with a pawn-value of $30,000 you might be able to borrow a maximum of around $18,000 perhaps a few thousand more depending on the condition of the car.

Loans are available from $1,000 to $50,000. In some cases we will consider lending more.

Will it be a cash loan?

Yes – our hock loans are usually settled in cash. That is cash in your hand. Sometimes customers want us to pay the whole amount to someone else via a bank transfer, or just some of it and the rest in cash. We’re flexible either way. The point is, when you hock something loans are almost always cash loans. This is why pawn loans are so popular these days. Another reason, for the popularity of hock loans, is that no one knows that you’re getting a cash loan because it doesn’t go through your bank account and is not registered on your credit rating file. So your privacy and discretion are assured. If you have a bad credit rating or you are being chased for cash, getting a fast cash loan against your car by hocking it with us is a logical and quick solution to your immediate cash flow problems. No one needs to know but you. We hope you find this information helpful. For more details about how to hock a car, visit ePawn’s car pawning page.

Do you get more if you hock a car or sell it?

Often, you can get more money for your car by selling it. However, with a pawn loan, you can get the money you need, instantly, and you get to keep your car. Learn more about the advantages of hocking your car over selling it >

Can I hock my car with a bad credit rating?

The short answer is yes. People often ask us, does a bad credit rating matter? Your good or bad credit rating is not a reflection in obtaining a cash loan from us because you are pledging your car as collateral by handing it over to us until your loan (and any interest due) is repaid in full. This is the essence of pawning. Learn more about >

To learn more about our pawn loans please visit our FAQs page by clicking on the button below: